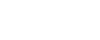

Roughly one in 10 respondents are cancelling their plans to buy or sell a home because of inflation. 29% are delaying homebuying plans due to inflation, while 24% are accelerating their plans.

Seventy-three percent of homebuyers and sellers say inflation is influencing their future buying or selling plans, according to a recent Redfin survey.

Twenty-nine percent of respondents said they're delaying homebuying plans due to inflation, defined in the survey as rising prices of goods and services. Twenty-four percent of respondents are moving up their homebuying plans and 11% are canceling plans altogether. Meanwhile, 10% of respondents said inflation is causing them to move up their home selling plans, 7% are delaying their selling plans and 3% are canceling.

The Redfin-commissioned survey is of 1,500 U.S. residents who are planning to buy or sell a home in the next 12 months. The survey was fielded by research technology company Lucid from December 10 to 13, 2021.

"The way Americans interpret news about rising prices can have a variety of effects on their financial decisions, including homebuying," said Redfin Chief Economist Daryl Fairweather. "Some people may delay buying because they're worried that with prices rising on everything from food to fuel, now is not the right time to make a huge purchase. But others might move faster to find a house because they're worried home prices and rent prices will increase even more, and they want to lock in a fixed payment."

The survey results come amid reports that inflation is at its highest level in nearly 40 years, with consumer prices jumping 6.8% in November from a year earlier. Increasing prices for gas and other energy sources are driving the inflation surge.

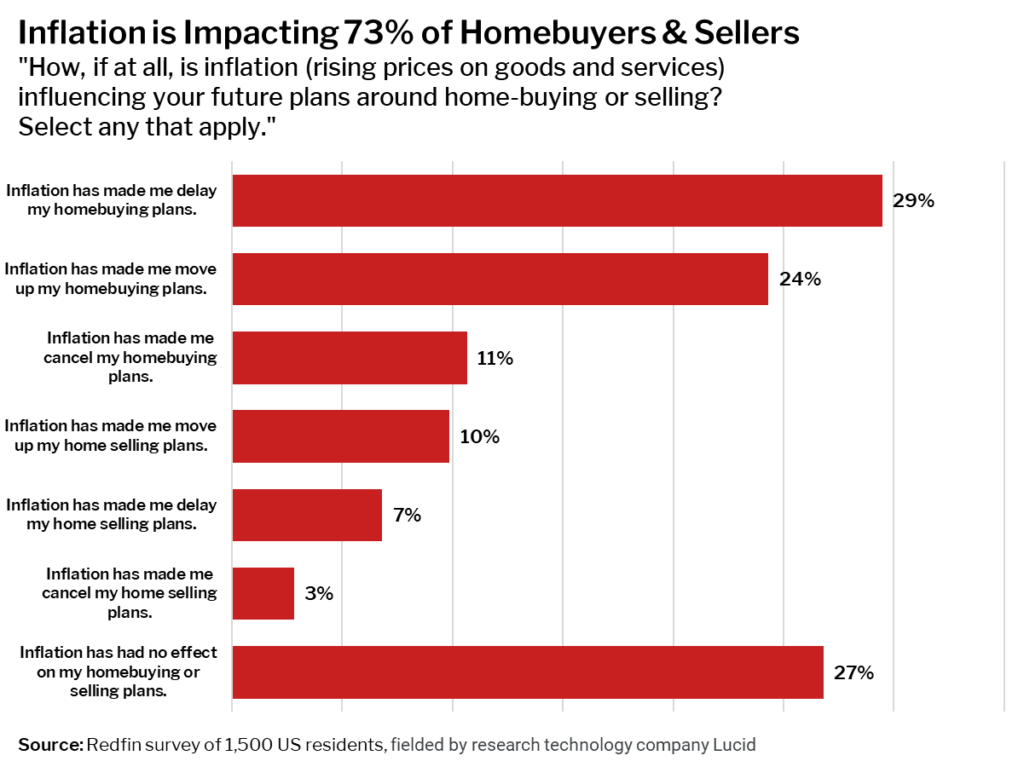

On that note, 73% of survey respondents said rising gas prices are impacting decisions about their homebuying plans or their commute. Thirty-five percent said they plan to drive less or drive a more efficient vehicle because of rising gas prices, while 25% plan to shorten their commutes. Twenty-one percent said they plan to buy a cheaper home.

"Different homebuyers react to high fuel prices in different ways, depending on their circumstances," said Redfin Deputy Chief Economist Taylor Marr. "Some people will pay a premium to shorten their commute, while others will opt for a more affordable home to make up for expensive gas or a new – but more fuel-efficient – vehicle."

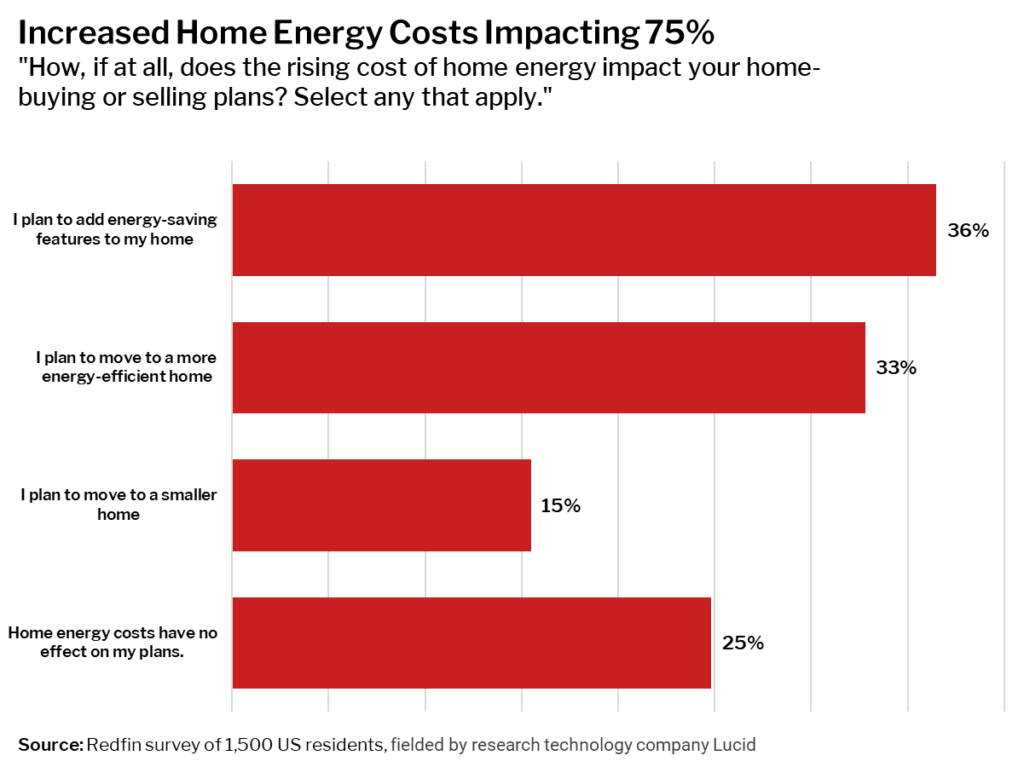

Three-quarters of respondents said the rising cost of home energy is impacting their homebuying or selling plans. Specifically, 36% of respondents said they plan to add energy-saving features to their home, 33% plan to move to a more energy-efficient home and 15% plan to move to a smaller home.

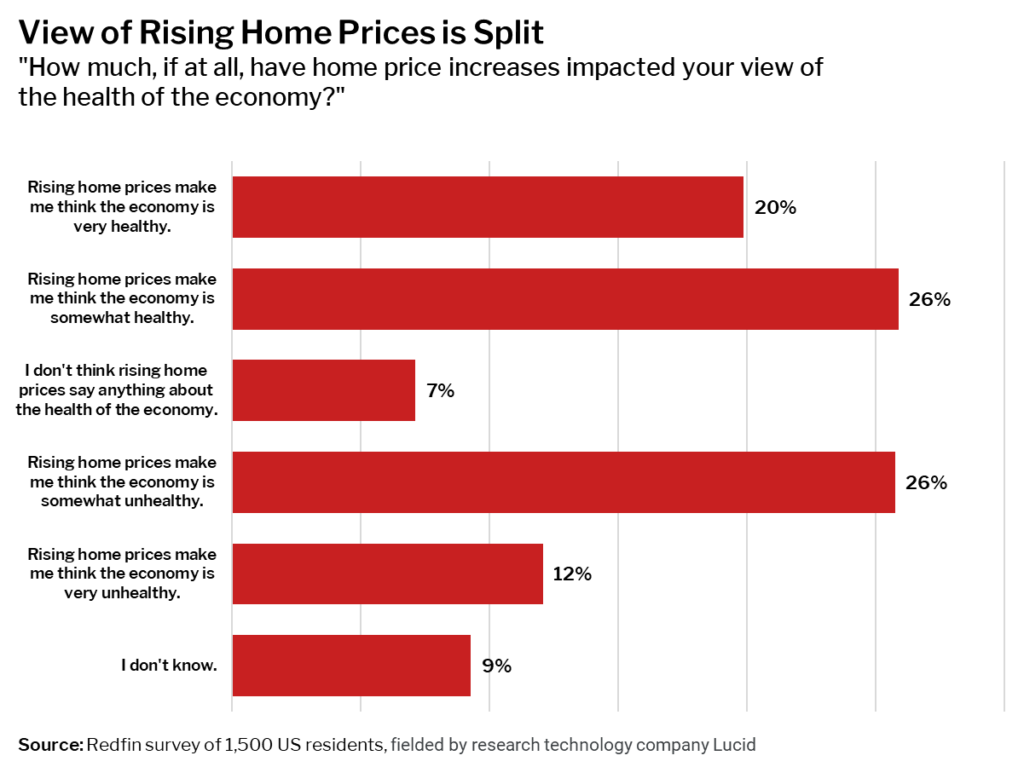

Nearly half of homebuyers and sellers view rising home prices as a sign of a healthy economy

Meanwhile, 46% of respondents say rising home prices make them view the economy as healthy, versus 38% who see rising home prices as a sign of an unhealthy economy.